Entering medical school is an exciting step toward a rewarding career in medicine. However, it also often involves navigating the complexities of financial management, particularly when it comes to handling medical student loans and personal expenses.

The journey through medical school is not just about becoming a great doctor; it’s also about learning to manage the responsibilities that come with it, including financial ones. By taking control of your finances early, you’re paving the way for a more secure and less stressful future.

Understanding Your Student Loans

Most medical students fund their education through student loans, which can be a significant source of stress. The first step in managing these loans is understanding them. Know the types of loans you have taken out, their interest rates, and their repayment terms. Federal loans often offer more favorable terms and repayment options compared to private loans. Be aware of your grace period – the time you have after graduating before you need to start repaying your loans.

Subsidized vs. Unsubsidized Loans

Subsidized loans are preferable as the government pays the interest while you’re in school. On the other hand, with unsubsidized loans, interest accrues even while you’re studying. It’s wise to pay at least the accruing interest on these loans during school to prevent your total debt from ballooning.

Creating a Budget

Budgeting is not the most exciting task, but it’s incredibly important. Start by tracking your monthly income, which may include any part-time job earnings or financial support from family. Then, list out your expenses – everything from rent and groceries to textbooks and equipment. Be realistic about your living costs and try to identify areas where you can save money. Remember, small savings can add up over time.

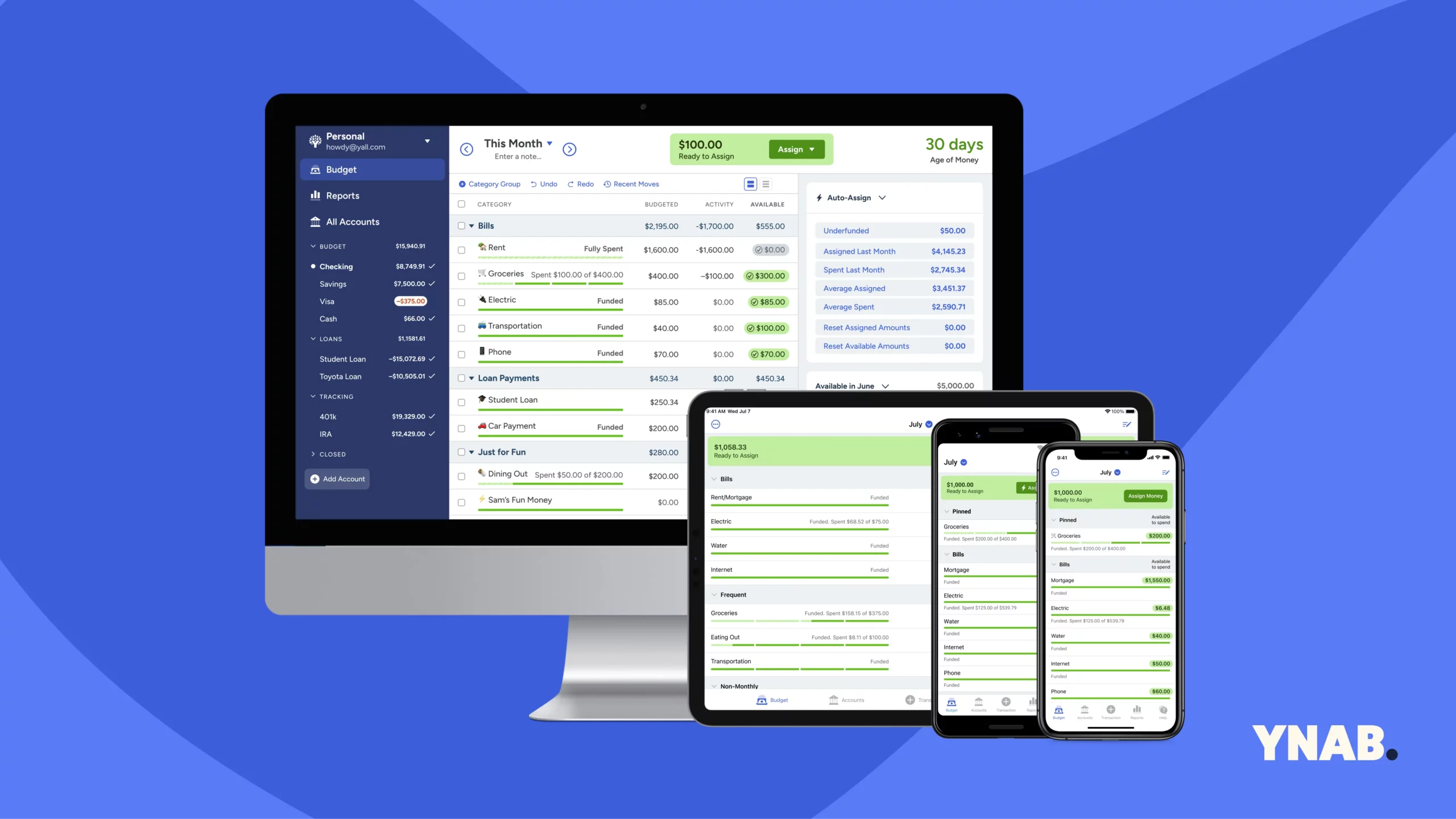

YNAB (You Need A Budget) is an ideal budgeting app for medical students. It simplifies budget creation and expense tracking, requiring only three steps to set up. Users first establish budget goals across various expenses like rent, groceries, and entertainment. Next, they link or manually enter their bank accounts. Funds are then allocated to these expenses, with an auto-assign option for efficiency.

The main budget page visually indicates financial status: green for covered expenses, yellow for partially covered, and gray for uncovered. Overbudgeting is clearly highlighted in red, with an option to adjust allocations.

Needs vs. Wants

Differentiate between needs (essential living expenses) and wants (non-essential items). While it’s okay to treat yourself occasionally, regular splurging can lead to financial strain.

Saving and Emergency Funds

It’s advisable to save a little every month, even if it’s a modest amount. This habit can help build an emergency fund, which can be invaluable for unexpected expenses like car repairs or medical bills.

Finding Ways to Save

Saving money as a medical student may seem daunting, but there are numerous small changes that can make a big difference. Start by seeking out student discounts – many businesses offer reduced prices on everything from software to gym memberships for those with a valid student ID.

Buying used textbooks or opting for digital versions can also lead to significant savings. Consider forming study groups to share resources and split costs. When it comes to daily living, simple acts like cooking at home, using public transportation, and cutting unnecessary subscriptions can cumulatively save a substantial amount. Remember, being frugal now can ease financial pressures and contribute to a healthier financial future.

Loan Repayment Strategies

As you approach graduation, start planning your loan repayment strategy. If you have multiple loans, consider consolidation or refinancing options, which can simplify payments and potentially lower interest rates.

Income-Driven Repayment Plans

Explore income-driven repayment plans, especially if you anticipate a lower income during residency. These plans adjust your monthly payments according to your income level and can provide some financial relief.

Planning for the Future

While it’s important to focus on your immediate financial situation, don’t overlook the importance of long-term planning. Start by familiarizing yourself with the basics of retirement savings. Even as a student, if you have any form of earned income, consider opening an IRA (Individual Retirement Account) and contribute as much as you can.

Additionally, research and understand the benefits of employer-sponsored retirement plans, such as 401(k)s, especially since some employers offer matching contributions which can significantly boost your savings. Learning about investments and considering a diversified portfolio can also help in building a more secure financial future. The key is to start early, even with small amounts, to take advantage of compound interest over time.

Conclusion

Managing finances during medical school is undoubtedly challenging, but with a bit of planning and discipline, it can be made more manageable. Stay informed about your loans, create and stick to a realistic budget, save where you can, and plan for both the short and long term. This proactive approach to financial management will not only help you during your student years but will also set a foundation for financial health throughout your medical career.

Remember, the journey through medical school is not just about becoming a great doctor; it’s also about learning to manage the responsibilities that come with it, including financial ones. By taking control of your finances early, you’re paving the way for a more secure and less stressful future.

Here you can find more articles on the topic of life as a medical student.